As 2025 comes to a close, creator economy news hasn’t slowed down. Last Thursday, TikTok told staff it had signed a deal to spin off its US entity with mostly American investors.

But the saga continues as the transaction is still not complete. And a final TikTok deal—assuming it really does go through this time—still leaves lots of questions, including if the American app’s algorithm will make TikTok feel less like, well, TikTok. That could change how users, creators and advertisers use the app. We’ll be watching this story closely next year!

Still, this means TikTok gets to end the year in a better place than where it started: In January, the app shut down for roughly 14 hours in the US as the original deadline to sell or be banned hit.

We outlined some of the other most significant moments in the creator economy in 2025 in the timeline below. We also picked four more charts that we feel sum up the business of the creator economy this year. Let’s dive in.

The key themes that emerged from this year—and are reflected in this chart—include the convergence of Hollywood and creators, heightened regulation, AI and video podcasting. (We go deeper on these themes in our upcoming podcast episode, which will go live on Friday.)

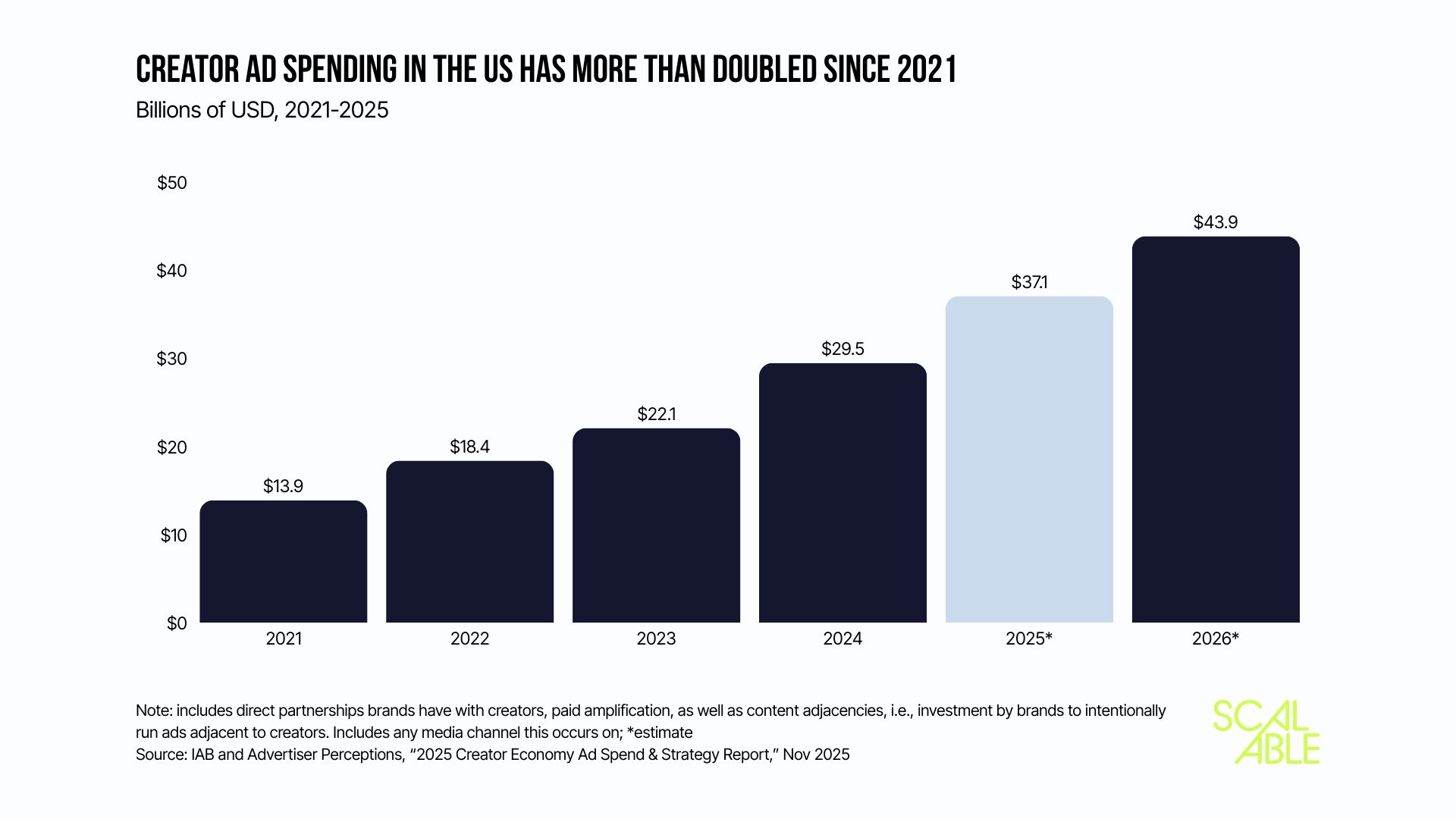

Creator ad spending is rising—but still hasn’t reached scale

In 2025, we finally got robust estimates for how much advertisers are spending on creators: $37.1 billion in the US, according to the IAB and Advertiser Perceptions. That’s more than double what US advertisers spent in 2021.

But that’s still only about a third of the over $100 billion US advertisers are estimated to spend on social network ads this year, per EMARKETER. IAB’s estimate also includes paid creator ads, such as Meta’s partnership ads, as well ads on non-social channels, meaning that direct creator partnerships are still only a small slice of most ad budgets.

That speaks to one of the big themes we heard in our end-of-year conversations with industry experts: The creator economy is now part of the mainstream, but the industry is still undervalued and dollars haven’t fully shifted.

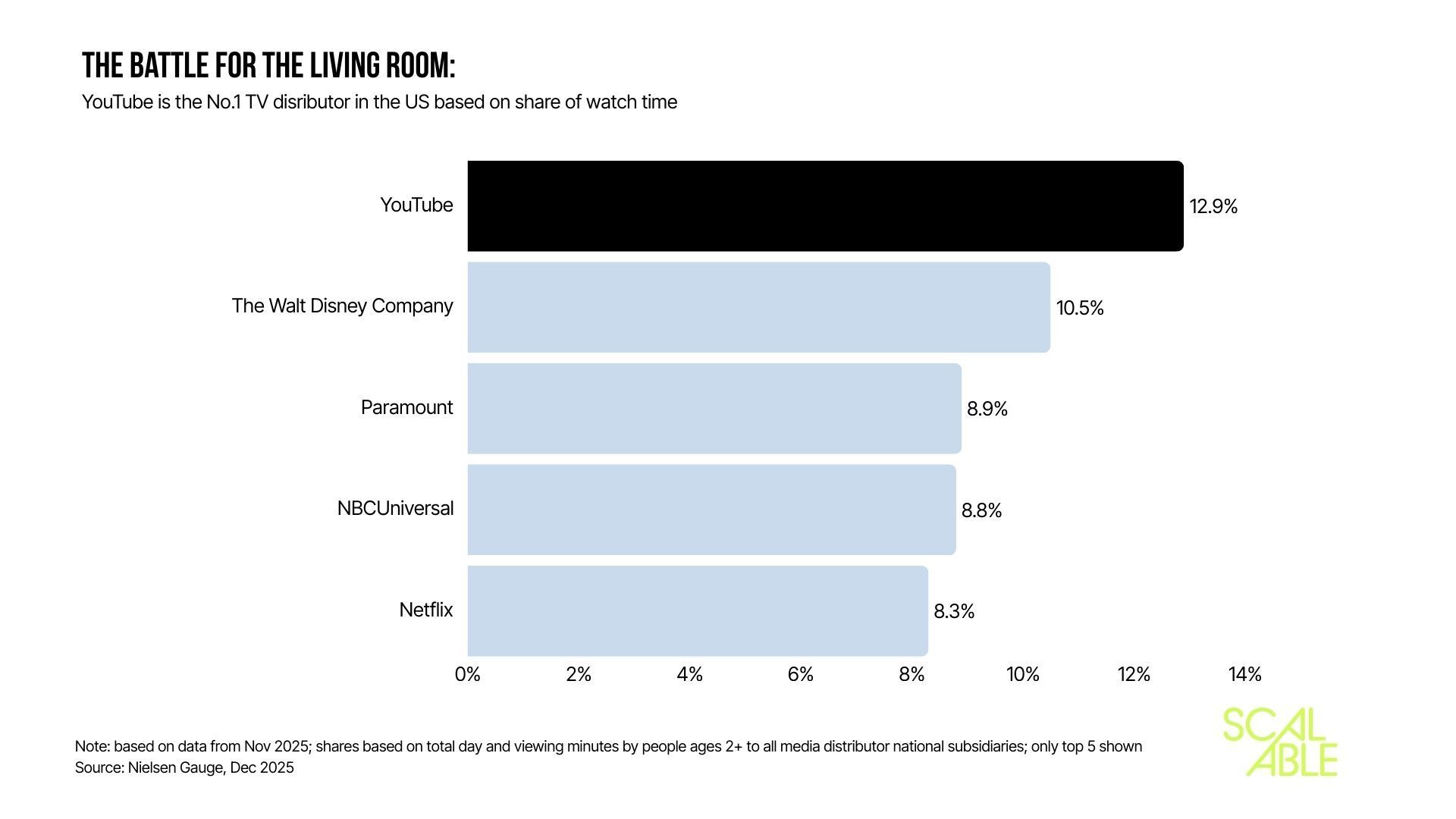

YouTube is now TV. So is basically everything else

YouTube started and ended its 20th birthday year on a high. In February, it overtook The Walt Disney Company to become the No.1 TV distributor in the US based on watchtime, per Nielsen, a position it has held since then. In December, YouTube announced that it had secured the rights to stream The Oscars starting in 2029.

As we noted in last Thursday’s newsletter, it’s getting harder and harder to argue that YouTube isn’t TV. But one thing is clear: It’s not the TV we grew up with. For example, YouTube says it also now has over 1 billion monthly podcast viewers. That makes it the platform to beat for the likes of Spotify and iHeartRadio, both of which struck deals with Netflix this year to bring video podcasts to the streaming platform. Many of the top YouTube channels are also run by creators, who are now producing TV quality content, rather than traditional media studios.

To us, this is a sign of both the convergence of creators and Hollywood, as well as a clear signal that everything is becoming “TV” now, as Derek Thompson pointed out in this article. Another case in point: Instagram launched a TV app for Amazon Fire TV devices in the US in December. Even Beehiiv, our newsletter publishing platform, introduced a YouTube integration this year as more writers and journalists (like us!) turned to video.

Traditional media turned to creators and AI

Traditional media decided it wasn’t going down without a fight this year. Creators were a key part of their strategies, from The Washington Post announcing a creator network to MrBeast’s Amazon reality TV show announcing a collaboration with “Survivor,” one the of the longest standing TV franchises.

The urgency for these legacy institutions to reinvent themselves is now higher than ever: This year, spending on social video ads, excluding YouTube, is expected to surpass linear TV ad spending in the US for the first time, per EMARKETER estimates.

In another major move, Disney in December announced a licensing deal with OpenAI’s Sora, which lets users turn text prompts into videos featuring their favorite characters. The top user-generated videos will be streamed on Disney+, further blending old and new media. It’s also a recognition that as more of the most popular content is being created and distributed by users and creators—who now have more tools to do so—traditional studios must adapt.

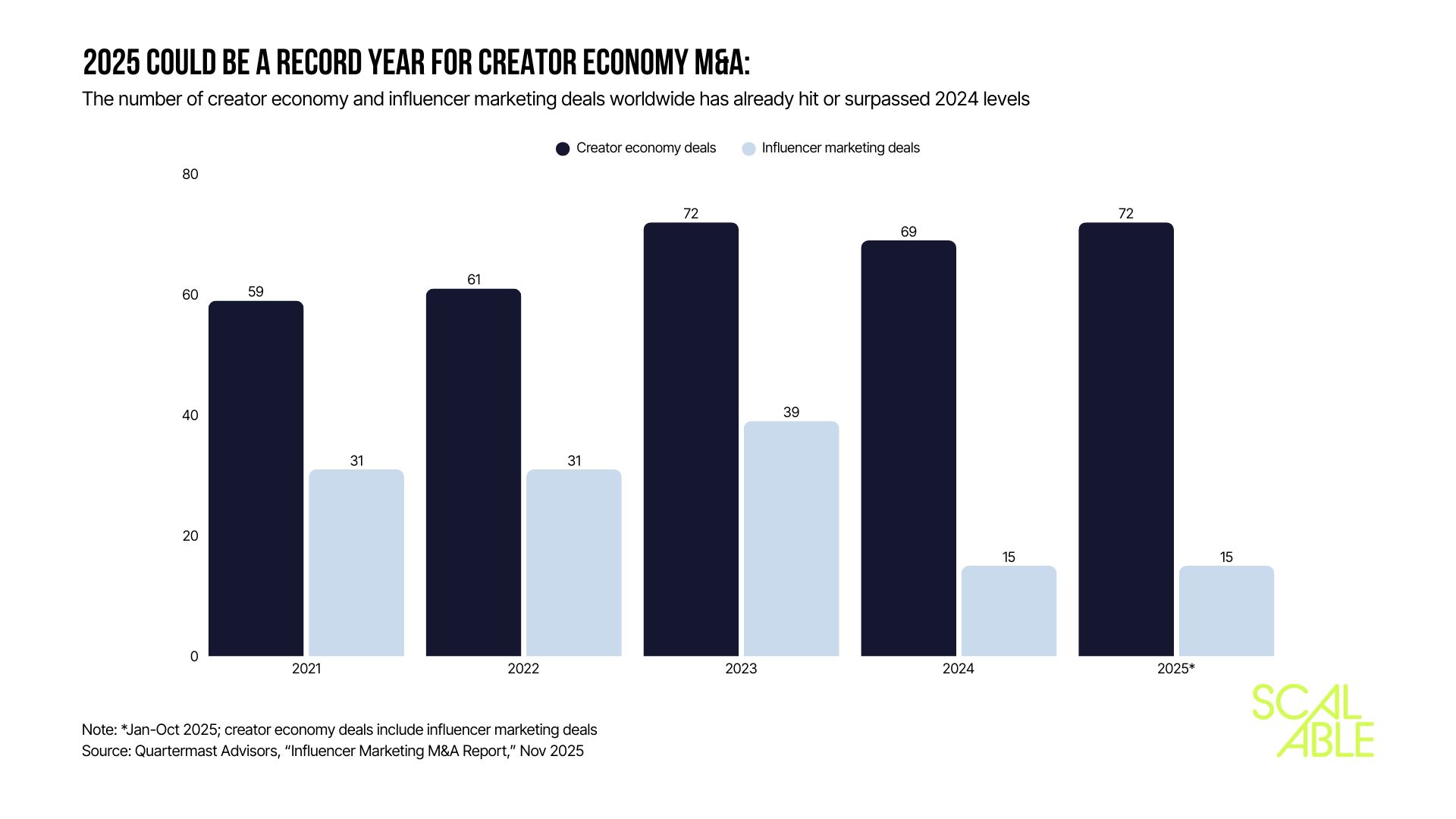

Creator economy M&A is on track to hit a new high

Between January and October of this year, there were at least 72 deals, matching the previous record from 2023, per Quartermast Advisors. The number of influencer marketing deals were also on the uptick again, though they now make up a smaller share of total deals than in previous years. That’s likely because there were so many transactions in 2023, but it also shows how diverse the creator economy has become, including the companies in it and the investors backing them.

Since we first covered this research, we’ve seen more creator economy-related transactions, including mega mergers like Omnicom-IPG and smaller deals like Pinterest’s purchase of TVScientific and WPromote’s acquisition of Giant Spoon. In December, Netflix also announced it would acquire Warner Bros., which we think could have a ripple effect on YouTube.

Startup funding has been rebounding, though it hasn’t returned to the same level as 2021 when investor interest peaked. One big shift this year was that new types of investors started betting on creators, such as Slow Ventures launching its dedicated creator fund and more private equity investors moving into the space. We also saw what may be the start of an emerging trend of creators investing in each other, with Bartlett’s backing of the podcast “Hot Smart Rich.”

Next Tuesday, we’ll share what themes we think will define 2026 and give you our predictions.

In other news…

The Round Up

iHeartMedia’s app will expand to support video podcasts, in addition to audio, early next year.

TikTok Shop is rolling out digital gift cards in the US, though the move comes late in the holiday season. The app is also offering incentives to new TikTok Shop sellers, including up to $6,000 in coupons, per Digiday.

The Tribeca Festival will now include social media creators in a new category, marking the first time a major film festival is including influencer content.

Humanz, an influencer marketing company, announced $15 million in new funding and that it’s acquired two other creator marketing businesses: Ubiquitous and Bambassadors.

Snapchat launched Quick Cut, a new video editing tool that allows users to turn their saved memories on the app into videos.

HardScope, a new company founded by DraftKings co-founder Matt Kalish, launched last week with the aim of helping creators grow their businesses. Its services include providing investments, connecting them with brands for deals, clipping their content and helping them launch consumer brands.

YouTube Yarns

YouTube shut down two widely-followed channels that used AI to create fake movie trailers, Deadline reported. The two channels, Screen Culture and KH Studio, together had more than 2 million subscribers and more than a billion views.

WPP Media expanded its partnership with YouTube to bring non-public YouTube creator data into its offering for clients through its influencer marketing shop, Goat Agency, and AI operating system WPP Open. The lack of robust, standardized data is now the biggest challenge to scaling influencer marketing strategies.

Creator Moves

TikTok held its first U.S. TikTok Awards event in Los Angeles on Thursday night. Jasmine was there to see the winners, which included Keith Lee as creator of the year, @findjeremiah as rising star and Alex Warren as “Breakthrough Artist of the Year.”

Mythical Entertainment's food review and commerce brand Sporked was acquired by Savage Ventures, which also owns media publishers Vice and Motherboard.

YSE Beauty, a skincare brand founded by model Molly Sims, raised $15 million in Series A funding led by Silas Capital.

Alan and Alex Stokes, better known as the Stokes Twins, signed with CAA. Their YouTube channel has about 133 million subscribers on YouTube.